Renovation Concierge Service

OVERVIEW OF THE PROGRAM

Agents learn – How to List and sell more

As-Is Homes!

Renovation Made Easy

How to list and sell more As-Is homes – Step by Step

Interested in a home in need of repairs? Have you found something oozing with potential but in need of repairs in order to get traditional financing.

Renovation Lending options often provide the precise tools required to purchase homes in this condition while financing the necessary or desire repairs.

The Process

Step One

Identify Expired and Off-the-Market Listings and do some door-knocking to talk to the seller about the propgram.

Step Two

The seller will list the home with you As-Is. They will not need to do any repairs to the house.

They will need to commit to ordering a Feasibility Report.

Step Three

The home is Listed and Marketed as a Renovation Ready Home with the Feasibility Report to let the new buyers know what needs to be repaired.

Benefits Of Ordering A Feasability Report

What is the report

In general, the benefit of ordering a Feasibility Study lies in its ability to provide the borrower or prospective homeowner with specific information about the property and the cost of repairs or proposed construction to the home. It is also often used as the basis for making the proper investment decision by the lending institution, as it helps illustrate the potential future value of the property.

The report details the extent of the proposed rehabilitation and the cost of repairs. It is considered an extremely prudent practice to have this report on hand before submitting a formal offer to purchase. It ensures a buyer knows what is needed to complete the project, allows the seller to determine what they are willing to repair before listing the property to maximize their potential sale price, and increases an agent’s success rate when showing distressed homes.

How does it work?

- Your HUD consultant will walk the property, identifying health and safety concerns and the items you wish to repair or add to the property.

- The compilation of costs with descriptions of each part of the project will be presented in an easy-to-read line-item fashion, detailing the labor and material costs for the improvements.

- Once you have received the report, it can be leveraged for your decision-making process, allowing you to determine if this is the right home for you or if you feel it is best to continue looking.

- Advantages for the homebuyer include establishing the required repairs on a property to meet HUD’s minimum standard. The buyer can also address upgrades to the home’s systems or dated items like kitchens and baths, which can make all the difference in the functionality of a home. This often leaves prospective buyers feeling like the home was specifically designed for them. With the report in hand, a buyer can seek out competitive bids from contractors, allowing them to compete. The Consultant that completed the report is usually willing to assist in evaluating the merit of each contractor’s bid; pointing the home buyer in the right direction.

- A Real Estate Agent who works with distressed properties & REOs can use the information in a Feasibility Study to assist in establishing a home’s market value and asking price. It is a solid addition to the presentation of a home because it allows the prospective buyer insight into what the required repairs look like from the beginning. This has been shown to help sell more homes due to establishing proper expectations from the beginning. An agent should consider aligning with a lender specializing in the available renovation programs, including the 203k, to provide a seamless and smooth purchase process for their borrower and future referral partner. In addition, the Feasibility Study may eliminate the need for a home inspection. Alternatively, a consultant can complete a full Work Writeup accounting for any additional upgrades and changes the home buyer seeks.

- Believe it or not, all parties, including the seller, potentially benefit from a Feasibility Study. Knowing the extent of required repairs on a property can allow a seller to leverage the after-improved value as a mechanism for negotiation. It can also allow the seller to address some or possibly all deficiencies if performing the improvements before listing makes sense.

- In the end, the information in this report and the potential future Work Write-up will be used by an appraiser to establish the after-improved value of the property, which will be leveraged to validate the homeowner’s borrowing power. Suppose future value does not support the cost of repairs. In that case, the buyer will know it is in their best interest to look for another property or potentially renegotiate the purchase price.

Example Renovation Project:

- Purchase Contract: $500,000

- Renovation Amount $100,000*

- 10% Contingency Reserve based on the renovation amount of $10,000*

- Supplemental Origination fee of 1.5% or $375.00 The greater of the two. $1,500 based on the $100,000 renovation*

- HUD Consultant Report $1,500 (paid on inspection), but customer can receive a reimbursement at closing if they wanted*

- Five draws based on the renovation amount of $350 x 5=$1,750*

- Any other soft fees such as architect, engineer, permits, sewer, and water tap fees if required. If the home is not habitable during the renovation, the customer can roll up to 6 mortgage payments into the loan based on the HUD Consultant’s recommendation.*

- Total Loan (adding the above figures): $613,250

- $613,250 with a 3.5% down payment on an FHA 203k loan, 5% on a conventional loan, and 100% financing on a VA or USDA loan.

- *The fees on the renovation loan can be rolled into the loan or paid out of pocket.

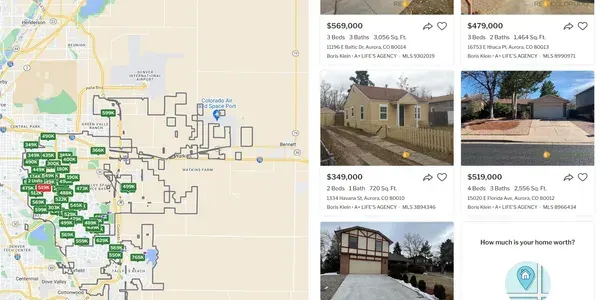

Sample Listings

There are hundreds of homes currently on the market being marketed as cash only/investor because the listing agents are not aware of the renovation programs available to primary home buyers. These programs are also available to buyers looking for second homes, and investment homes.

What Is A Renovation Loan…

- The renovation program helps homebuyers finance the purchase/refinance of a property and pay the cost of renovating the same home. The total loan amount will include your home purchase or refinance plus all the required and desired repairs/upgrades. Otherwise, the potential buyer would be unable to look at homes requiring major or minor repairs. The FHA 203k, VA, and Conventional programs offer a simple alternative to financing upgrades/repairs on the house, and all repairs and upgrades are started after closing on the home loan.

- With the renovation loan, you don’t need to limit yourself to what types of properties you can look at and place offers on.

- Other than financing a home purchase, you can use the renovation mortgage to refinance your existing mortgage. The new loan proceeds can be used to pay your current mortgage and finance all the repairs into the same loan.

Help a Veteran with a VA Renovation Loan.

Many Veterans need to upgrade their homes to make them livable—for example, adding ramps to get into the house, lower cabinets, walk-in bathtubs, and wider doors, to name a few upgrades to improve their lives. The VA Renovation loan can be for purchasing or refinancing their current home.

Examples of repairs and Upgrades:

- HVAC or plumbing upgrades

- New insulation

- Mold Remediation

- Weatherization

- Repairing or replacing flooring

- Removing lead paint

- Adding a ramp for wheelchairs or other accessibility improvements

- Repairing or replacing a roof or gutters

- A veteran can have many more improvements to their existing or new home they want to buy.

How VA rehab and renovation loans work

VA Renovation loans work similarly to regular VA loans but have a construction component. The Veteran will have to get estimates from a VA-approved contractor for the work you’d like to have done. An appraiser will then give an estimated home value after the proposed changes have been completed, also called Future Improved Value.

What is a 203k Renovation Loan:

Section 203(k) insurance enables homebuyers and homeowners to finance a house’s purchase (or refinancing) and the cost of its rehabilitation through a single mortgage or to finance the rehabilitation of their existing home. Purpose: Section 203(k) fills a unique and critical need for homebuyers.

Repair types that are allowed on a Limited 203k loan.

- Replace or repair existing HVAC systems.

- Replace or repair roofs, including gutters and downspouts

- Replace or repair plumbing systems

- Update floor and flooring treatments

- Interior and/or exterior painting

- Update appliances

- Waterproof basement

- Home weatherization

- Door and/or window replacement

- Enhancing home accessibility

- Update the home’s electrical wiring

- Replace/repair the home’s exterior

- Make energy-efficient improvements

- Installing a septic system or a well

Repair types that are allowed on a Standard 203k loan.

- Major rehabilitation and structural repair

- Renovations that require detailed architectural drawings

- Major landscape work and site improvements *Restrictions apply

- Elimination of safety or health hazards

- New addition construction

- Site amenity improvements, such as landscaping *restrictions apply

- Repairs that will require you to live elsewhere while the renovation is done. In this scenario, you can roll up to six months of mortgage payments into the loan.

- Fix or replace a septic tank and leach field

- Fix, drill a well deeper or a new well

- All repairs allowed on a Limited and much more

- Adding an Accessory Dwelling Unit

- *These upgrades need to add value to the home

What is a Conventional Renovation Loan?

Essentially, the conventional renovation program – and other products like it – enables home buyers to borrow both the purchase price of the potential home and any renovation costs and wrap it up into one mortgage loan amount. The Conventional Renovation loan is available for Primary Home, 2nd Home, and Investment homes. Have that accessory dwelling unit built for you for a rental, or have an aging parent move in.

Repair types that are allowed on a Conventional Renovation

Any repairs/upgrades can be done with the conventional renovation program, including luxury upgrades such as adding a pool. Adding an Accessory Dwelling Unit or an outdoor kitchen.

HOMES IN ALMOST ANY CONDITION QUALIFY FOR A RENOVATION FHA, VA, USDA AND CONVENTIONAL LOAN.

Contact Us

Renovation Concierge Service

Contact us to learn more about our “How to list and sell more As-Is homes” Program

Office: 855-644-5626

Email: [email protected]